He's called every bull and bear market in crypto since 2012. Now he says …

"Buy This Coin ASAP …"

Giant Wall Street firms, like BlackRock and Fidelity, are quietly moving billions out of Bitcoin — and into a handful of little‑known cryptos.

Dear Reader,

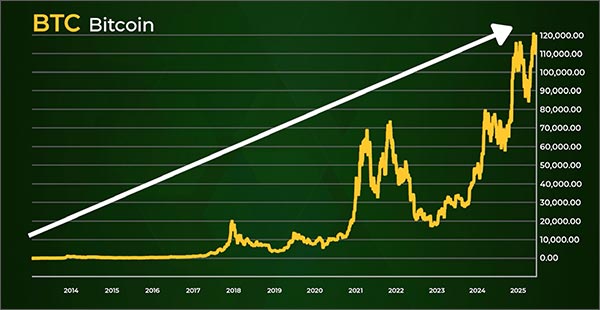

There’s been no better investment on the planet this past decade than Bitcoin.

Not gold …

Not bonds …

Nothing.

It’s not even close.

Over the last ten years …

Bitcoin’s returns have more than doubled that of gold, real estate and stocks …

COMBINED.

Think about this …

A simple $1 investment in Bitcoin when it first traded seventeen years ago …

Would be worth more than 100 million.

That’s enough to make your head spin.

It might give you a serious case of FOMO.

Because there’s a good chance that everyone missed out on Bitcoin’s rise.

Even this year …

While the S&P 500 was hitting record highs …

It’s still down 15% to Bitcoin.

As a matter of fact …

Since 2012, the S&P 500 has lost 99.98% of its value when compared to the digital asset.

But …

Before you rush to move your retirement plan into Bitcoin …

Hoping for these types of gains …

I’ve got news for you.

It’s not going to happen.

Sure, Bitcoin still has plenty of runway.

It could even hit $150,000 before the end of the year.

And it should remain a strong part of any crypto portfolio.

However …

The stark reality is …

The days of seeing exponential returns on Bitcoin …

Are in the rear-view mirror.

At least, according to Juan Villaverde.

And if anyone would know, it’s him.

Juan’s unique timing model …

Helped him call every bull and bear market in crypto since 2012.

He pinpointed the top AND bottom of Bitcoin to within days in 2018.

While correctly calling for it to cross $100,000 last year.

As a matter of fact …

Since 2022, Juan’s closed out wins of 153% …

334% …

Even 478% …

All solely on the rises and falls of Bitcoin.

However …

His model is now alerting him to something drastic.

A seismic shift that’s reshaping the crypto landscape.

While presenting potential investors with an amazing opportunity.

There are a handful of exceptional cryptos emerging …

With the potential to blow past Bitcoin.

And it’s all happening at a rapid pace.

Wall Street’s Billion Dollar Crypto Pivot

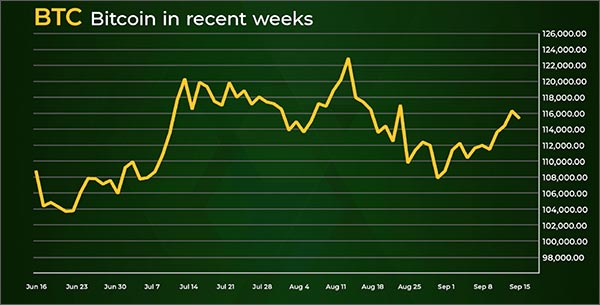

As Bitcoin surged to an all-time high of $123,000 …

It made up, at that time, nearly two thirds of the entire market capitalization of crypto.

Meaning 66 cents of every dollar invested in crypto …

Was in Bitcoin.

But that number has dropped drastically in the past few weeks.

Now Bitcoin is making up barely half of all crypto investments.

This is a signal …

We believe there is a massive opportunity brewing …

For those who know exactly where to look.

Because as we speak …

The top Wall Street firms are quietly moving money out of Bitcoin …

Into a small handful of critical coins.

This transition could permanently alter the world of crypto.

With one specific name leading the charge.

BlackRock, the world’s largest asset manager …

Moved $561 million worth of Bitcoin into this crypto over a two-day period.

While injecting $1.1 billion into this special coin in just 48 hours.

Fidelity bought more than $210 million of it in one single day in July.

Even JPMorgan is investing heavily.

The same JPMorgan run by CEO Jamie Dimon …

Who once referred to Bitcoin as a “hyped-up fraud” …

Calling cryptos “pet rocks that do nothing.”

The rush from Wall Street into using this digital asset is staggering.

Deutsche Bank …

Visa …

Citibank …

They’re amongst many who’ve hopped on board …

Including payment processors PayPal and Stripe.

But it’s not just the financial world.

Some of the biggest names in their respective industries …

Are racing to get involved with this emerging crypto.

Entertainment titans like Fox, Universal and Disney.

As well as software giants like Microsoft, Amazon and Google.

Even the likes of Spotify …

Budweiser …

Shopify …

Gucci …

Porsche and Lamborghini …

I could go on.

Now Juan’s model is saying this special coin …

Along with a few select others …

Are ready to lead the way in the next leg of the crypto boom.

Now, the U.S. Government is fully behind the movement.

President Trump himself owns somewhere north of $1 million of this coin.

As does World Liberty Financial …

That’s the crypto network his sons launched when he took office.

But that’s not what recently jolted the crypto world.

More than 330,000 worth of this coin was just moved into a U.S. government account.

Increasing the federal holdings of this crypto to 281 million.

With experts calling it a significant development in the crypto world.

Highlighting the trust that not only major financial institutions and corporations have in the asset …

But the U.S. government as well.

As the regulatory outlook for crypto continues to improve …

Moves like this could further boost investment in this new section of crypto …

And away from Bitcoin.

This sudden shift …

Is what’s causing a jolt to crypto’s nervous system.

But for Juan Villaverde …

It came right on time.

His timing model has seen this coming.

Just like it has for more than a decade …

Allowing Juan to nail every bull and bear market in crypto since 2012.

Scoring some of his biggest wins along the way.

Gains as high as 1,149% over a two-and-a-half-year period …

1,629% in just under three and a half years …

Even a 2,925% winner in just over two years.

Truth be told …

Dating back to 2018, Juan’s average gain is 288% …

And that’s including the losers.

It’s no wonder tens of thousands of people follow his every move.

Now Juan’s timing model is flashing green on a select few coins.

As another shift away from Bitcoin emerges …

This handful of tokens could significantly prosper as a result.

87 Times Better Than Bitcoin

The reality is …

This isn’t the first time that other cryptos have outperformed Bitcoin.

In fact …

In virtually every crypto bull market, the same scenario has played out.

Bitcoin takes off and produces an impressive return …

Only to see a handful of lesser known cryptos follow up …

And make Bitcoin’s gains look like small potatoes.

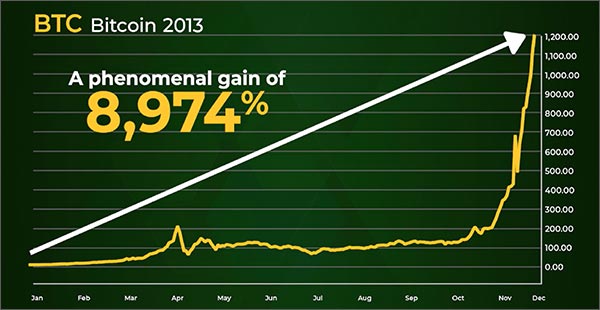

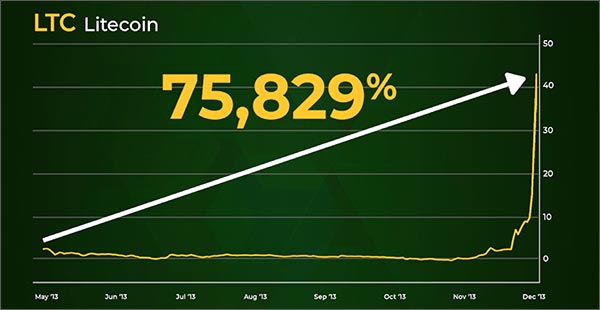

Go all the way back to 2013.

That was the first true crypto bull market.

Bitcoin started the year trading just above $13.

It crossed the $1,200 mark during its peak for a phenomenal gain of 8,974%.

A result any investor would be over the moon with.

However …

As the money began to shift away from Bitcoin …

There were even bigger gains to be had …

Much bigger.

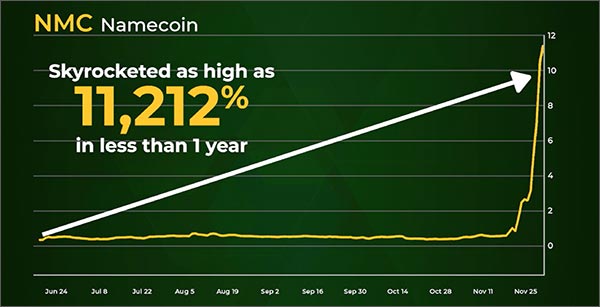

Some of the biggest included Namecoin …

Which skyrocketed as high as 11,212% in less than a year …

Litecoin went up an exceptional 75,829% at its apex in just 10 months.

That was eight times more than Bitcoin.

Then the story repeated in 2017.

Bitcoin charged out of the gate.

Registering a 2,281% gain at its pinnacle.

Still nothing to sneeze at …

But tame when compared to Dash, which climbed 13,900% in 2017 …

Or Ripple, who skyrocketed up 36,018% in the same time frame.

Finally …

During the 2021 crypto boom …

Bitcoin again surged into the lead.

From its low when the pandemic clobbered everything in the market …

Until it crossed the $65,000 mark in November …

It went up 1,205%.

However …

Cryptos like Ceek and Gala blew Bitcoin out of the water.

Rising by 25,000% and 40,000% respectively that year.

And these weren’t the only two.

During the first half of 2021 …

As investment in Bitcoin began to drop …

The top 100 coins NOT named Bitcoin gained 174% …

While the crypto leader went up a tepid 2%.

That’s 87 times better.

These specific coins had extraordinary runs.

Leaving all the others in the dust.

But now …

According to Juan’s timing model …

The signs are showing him that it’s happening again …

A pivot away from Bitcoin …

And an opportunity to strike gold in some far corners of the crypto market.

Over the last 90 days …

More than 70 other cryptos have outgained Bitcoin.

Some analysts believe this dip is going to continue.

Because this shift has an extra tailwind behind it …

The massive pivot by major institutions and governments …

Away from Bitcoin.

And into a smaller handful of coins.

For a select few of these …

It could be the beginning of an extended run of growth …

With the potential to outperform Bitcoin for the foreseeable future.

It’s imperative that investors not only move quickly …

But also, with accuracy.

That’s why I’m so excited to sit down with Juan today.

To discuss the next stage of this bull market …

And why Wall Street and more are moving beyond Bitcoin.

Juan’s also going to get into the nitty gritty of this breaking development.

Including a discussion about the coins that he thinks are going to benefit.

If you’re still kicking yourself for missing out on crypto …

Now could be your best chance to make good.

Because Juan is truly a master of his craft.

He’s a renowned econometrician …

He applied his mathematical formulas to Bitcoin …

And made an amazing discovery.

It …

Along with other cryptos …

Trade in specific cycles.

Not only that …

These rotations were much more consistent and predictable than stocks or bonds.

So, using this knowledge …

He built the world’s first crypto timing model.

Deploying it to nail every bull and bear market in crypto since 2012.

Those who’ve followed the model …

Would have had a chance to ride crypto’s wave …

While avoiding catastrophic losses.

Of course …

Not every prediction Juan made has been popular.

In December of 2017 …

When Bitcoin was skyrocketing towards $20,000 …

He alerted his followers that it was time to get out.

Some responded with hate mail …

He was even victimized by a targeted cyberattack.

But Juan didn’t back down …

He trusted his model …

And was proven right again.

Bitcoin fell 73% in 2018.

However …

Just three days before it hit rock bottom …

Juan tweeted to tens of thousands of investors that it was time to get back in.

Those who made that move …

Could have made more than 20 times their money.

Juan’s acumen is so impressive that since 2021 …

He’s made eight different trades that resulted in 1,000% gains …

Or higher.

Now his model is signaling the next batch of coins with this type of potential …

All as a result of this shift away from Bitcoin.

Juan, it’s an absolute privilege to sit down with you today.

I’ve been looking forward to this for quite some time.

Juan: Chris, I’m thrilled to be here.

It’s an amazing time to be involved in crypto.

Chris: Okay Juan, let me start with the question that I’d guess is on everyone’s minds.

Bitcoin just recently hit an all-time high of $123,000.

But you’re suggesting there’s a massive pivot away from it.

So, I need you to give us some perspective on it. What is going on?

What gives?

Juan: Great question, Chris.

For years, Bitcoin has dominated the crypto narrative.

But the reality is …

Its uses are actually very limited.

It’s simply a store of value.

Meanwhile …

The entire cryptocurrency landscape is shifting below our feet.

The Trump administration has gone full bore on crypto.

Relaxing regulatory restrictions …

And helping pass legislation that is giving the industry real legitimacy.

With the U.S. government’s full support behind it …

Crypto has become massively appealing to major companies and financial institutions alike.

Particularly the cryptos with the technology and tools to solve real world problems.

Like the one I’m so excited about.

Chris: Are there a lot of these types of cryptos out there?

Juan: Absolutely not.

Honestly, most crypto analysts won’t tell you the truth …

But the majority of cryptos on the market are hot garbage.

Our proprietary ratings system evaluates almost 28,000 different cryptos.

And we rate less than 100 of them as a “Buy” or “Hold.”

Chris: That’s pretty amazing … less than 100 in total. So not many at all.

Juan: 0.4% to be exact.

That means we reject 99.6% of all cryptos — immediately.

We’re not into fads like meme coins or NFTs …

That can go from boom to bust in a heartbeat.

We are looking for cryptos that could have explosive long-term growth potential …

Because of their ability to serve as “real world assets.”

Chris: What do you mean by that when you say real world assets?

Juan: Essentially …

It’s a way for things like real estate or commodities …

Even stocks and bonds …

To be bought and sold as cryptos.

For example …

RealT is a crypto network that tokenizes U.S. properties …

Allowing users to buy and sell property directly through a token on their network.

Pax Gold allows you to buy gold anytime you’d like …

24 hours a day, seven days a week.

With each digital token backed by one ounce of troy gold.

Chris: That’s pretty incredible …

Juan: It really is.

With Congress passing legislation to give these assets legal authority …

The number of companies rushing to develop their own digital tokens …

Has shifted into hyperdrive.

I’m talking about some of the biggest names in finance …

Like Bank of America …

Citigroup …

Wells Fargo …

Even JPMorgan wants in.

Chris: Sounds like Jamie Dimon has gone from skeptic to believer.

And this goes beyond finance?

Juan: Absolutely.

Retailers like Amazon and Walmart are racing to create their own versions.

Tech giants Apple, Google and Meta are as well.

PayPal …

Airbnb …

It’s only just beginning.

Treasury Secretary Scott Bessent believes …

This is the future of the global financial system.

Calling it a …

“A revolution in digital finance.”

Adding that, “The U.S. has entered the golden age of crypto.”

And one specific crypto already has a hold on more than 50% of this emerging market.

They’re becoming essential to the financial world.

Chris: Okay that’s a pretty bold statement, Juan.

What makes them so essential?

Juan: Well, their advanced blockchain technology.

They’ve developed a platform that settles transactions automatically.

While ensuring they are safe and secure.

It’s going to save companies a lot of time and money.

Chris: Did I hear you say automatically, Juan?

Juan: That’s right, Chris.

It’s written into this crypto’s code.

The instant that the conditions of the agreement are met …

The contract is locked and binding.

Visible for all parties to see …

But not alter.

That’s why this crypto is being used by nearly every industry.

Health care giants like Pfizer and Roche are employing it in their labs.

The top three logistics companies in the world: UPS, FedEx and DHL …

Are all on board.

So are software giants Oracle and IBM …

Shoemakers Nike and Adidas …

Luxury Brands like Coach, Burberry and Ralph Lauren …

I could go on and on.

Chris: Well Juan, I think you’ve led us right into the million-dollar question.

What is this crypto you are referring to?

Actually Chris, I’d call this a billion-dollar question.

Because that’s how much money is flowing into it almost daily …

In fact …

It’s added more than $150 billion in market cap since July 1st.

What I’m talking about is Ethereum.

Chris: I’ve heard of that one … it’s probably the second most popular coin out there.

Juan: Yes, Ethereum is already a household name in crypto.

And if it’s not, it will be soon.

Because it’s seeing a mind-blowing influx of cash lately.

Corporate holdings of Ethereum surpassed $13 billion in August.

Meanwhile …

Ethereum ETFs just had their first ever billion-dollar day.

In fact …

BlackRock’s Ethereum Trust Fund went from $5 billion to $10 billion in just 10 days.

Becoming the third fastest exchange traded fund to reach this particular milestone.

Chris: No wonder they moved almost a billion dollars into it from Bitcoin.

Juan: They aren’t alone in that …

Tom Lee was the first major Wall Street strategist to hop onboard the Bitcoin train.

Stating way back in 2017 that Bitcoin was a “game changer.”

People thought he was nuts when he said that Bitcoin would hit $55,000.

Now …

He’s making the shift too.

Buying $800 million worth of Ethereum in just one week.

Saying that, “Ethereum is the preferred choice for Wall Street.”

And that it is, “Entering a 2017 Bitcoin moment.”

Chris: So clearly it sounds like investors should be stockpiling Ethereum, right?

Juan: Yes and no.

Listen, Ethereum is the bellwether of these real world assets.

I think it would be a wise idea for anyone to have Ethereum in their portfolio.

But what most people don’t know …

Is that any boost in Ethereum …

Could lead to an enormous surge in one other, lesser known crypto.

This is the special coin I’m talking about.

With all of this money surging into Ethereum …

I believe this other coin …

Could be the biggest winner of this crypto revolution.

Chris: Why would Ethereum’s move boost this crypto so much?

Juan: The fact is that this coin is handcuffed to Ethereum.

In fact …

It actually started on the Ethereum network.

But even though it’s branched out …

The pair are still bridged together.

With this coin providing the technical support Ethereum and its assets need.

That’s why I say the more that Ethereum rises …

The more this coin should rise as well.

Chris: But you believe this coin could rise exponentially more than Ethereum correct?

Why?

Juan: Because as I mentioned earlier …

Ethereum is now a well-known name in crypto.

I believe it has the potential to reach $10,000.

But even if it does …

That would only be a 123% gain from where it is right now.

Chris: That’s still more than doubling its value, Juan.

But you are suggesting that this coin has a higher ceiling?

Juan: Exactly, Chris.

My model says this coin could even triple in value in the next few years …

And possibly go even higher.

Chris: Sounds like this could be the best way to play this red-hot market …

And this radical disruption in the crypto narrative.

Juan: I think so.

Besides being linked with Ethereum …

This coin has a really strong foundation for long-term growth.

It operates on the world’s largest cryptocurrency exchange.

Allowing it to offer some of the lowest fees …

And fastest speeds available.

Its exchange can process an astonishing 1.4 million transactions per second.

Chris: That’s impressive.

Investors are never going to complain about things being fast and cheap.

Juan: No, they certainly aren’t.

Neither are companies who process billions of them a day.

Like Visa and MasterCard …

Who just announced partnerships with this crypto.

And just recently …

Three different companies have combined to buy nearly $2 billion worth of it.

Chris: Sounds just like you said before, Juan.

As Ethereum rises …

And money pours in …

The same seems to be happening for this crypto as well.

So, how can investors get their hands on it?

Juan: I’ve put everything you need to know in a detailed report called …

The Best Way to Play Ethereum’s Rise

Inside it you’ll get all the important info.

Including the name of the crypto …

Why my research is telling me it’s got a higher ceiling than Ethereum …

And just how high I think it could go.

However …

Before I do …

I have to talk about another crypto that’s got massive potential …

So much so that I believe …

It’s going to turn the big two of Bitcoin and Ethereum … into a big three.

Chris: I can’t wait to hear why Juan.

But in your view is this more of a long-term play?

Or can it really rev up during this current bull market?

Juan: Both, Chris.

It was one of the fastest growing cryptocurrencies of 2024 …

But I think …

Its potential goes well beyond just this run.

I think it could eventually be a household name not just to crypto enthusiasts …

But all investors.

Chris: So what is it about this coin that gives it the capability to make such a power move?

Juan: My research tells me …

That they have the best technology of any crypto out there.

It was developed by a former Qualcomm engineer.

And is currently one of …

If not the …

Fastest blockchain out there.

The best part is that it’s only getting better.

Chris: How so?

Juan: They are currently working on a once-in-a-generation upgrade.

That could make them the first crypto to truly match internet speeds.

Chris: That sounds like a big deal.

Juan: It would be a massive breakthrough.

It’s why so many big-time companies are waking up to their potential.

Google is enlisting them for their cloud services network.

Visa is the world’s largest payment network …

Processing over 720 million transactions daily …

Across more than 15,000 different financial institutions …

And 25 different currencies.

They use this crypto’s network to help process payments …

Because it does it four times faster than Visa can alone.

PayPal and Shopify have employed their services.

As have financial giants like Fidelity …

Citibank …

And Franklin Templeton …

In fact …

Bank of America said they could become the …

“The Visa of the Digital Asset Ecosystem.”

Chris: So, they are clearly going to be a major factor in this financial shift you’ve been talking about?

Juan: For certain.

As the global financial system continues to evolve … And companies continue pouring money into cryptos that can help their bottom line …

The buzz around this coin will grow louder and louder.

Andreessen Horowitz released a report on the state of crypto at the end of 2024 …

And it was the star of the show.

With the top venture capital firm saying its …

“growth is just beginning” and “its current price doesn’t reflect its potential.”

VanEck predicted two years ago it could grow by more than 1,200% in the next few years.

While Benzinga recently said …

That it could rise by close to 850% from its current level by 2030 …

Potentially more than 2,000% beyond that as it grows in relevance.

Chris: Wow, that would be astonishing, Juan …

How is that even possible?

Juan: Simple, Chris.

Despite their rapid growth and mainstream adoption …

It’s still worth less than 1/20th of Bitcoin and Ethereum combined …

With the technological prowess it has behind it …

I feel that it’s ultimately going to join those two cryptos at the top.

Investors who get in quickly could benefit in a big way from this potential surge.

Chris: Sounds like a great opportunity.

How can investors jump on board?

Juan: I’ve put a report together called:

Crypto’s New Big Three: The Coin to Match Bitcoin and Ethereum.

In this report, I’ll reveal the name of the crypto and where you can buy it …

As well as why I believe it could turn the crypto leaderboard …

Into a three-horse race.

Most importantly …

I’ll tell you just how high I think it can go.

But before I do …

There’s one other crypto you need to know about.

I’d be doing you a massive disservice if I didn’t mention it.

Because with the winds of Washington behind it …

This crypto’s massive upside just got even bigger.

Chris: All right, well I’m all ears. We need to hear about this — go ahead, Juan. How so?

Juan: As Congress continues to pass legislation that legitimizes crypto …

I believe the coins that can serve a purpose for major corporations will continue to soar.

Especially if they are connected with Ethereum.

Chris: And I take it this new crypto you are talking about is?

Juan: It sure is.

In fact …

It also started on the Ethereum network.

And remains connected with the rising asset.

That’s why a number of different companies …

Including Samsung and Opera …

Are incorporating its services.

But there’s an extra tailwind behind this particular token.

Chris: What’s that Juan?

Juan: It’s a favorite of the first family as well.

Chris: Well, that’s certainly going to help its chances.

Juan: No doubt.

This is the most crypto-friendly administration in history.

Using its position to not only help push crypto into the mainstream …

But also, to boost the ones they are aligned with.

The founder of this coin has been making serious inroads with the Trump family.

He’s even attended dinner hosted by President Trump …

And invested $75 million into World Liberty Financial.

Chris: That’s a pretty significant investment.

Juan: It certainly is.

Now …

This crypto is beginning to reap the rewards.

It just became the second largest holding in the World Liberty Financial portfolio …

Behind just Ethereum.

But it goes beyond that.

With the support of the White House …

This crypto is getting a prominent supporting role …

In this continuing shift of the world financial system.

It and Ethereum together provide more than 80% of the blockchain needed …

For Wall Street’s extensive move into digital currency.

Chris: So it’s not only connected to Ethereum …

It’s actually helping to provide the technical support for this massive transition?

Juan: Precisely.

This combined blockchain network is already valued at nearly $150 billion …

And I expect that number could continue to soar.

If it does …

This crypto will as well.

As a matter of fact …

Thanks to some of its strategic partnerships …

This emerging token has even expanded its reach beyond crypto …

Allowing users to buy stocks like Apple, Tesla or Nvidia on its blockchain.

This coin is really growing …

Seeing a 37% increase from last year in transaction volume …

And a 25% increase in daily users.

The second best of all cryptos out there in these metrics.

Chris: It sounds like there is a lot to like about this coin …

And it’s another terrific opportunity for investors.

How can they get involved?

Juan: I’ve put it all together in a special report I’m calling …

Trump’s New Favorite Coin: The Best Way to Play Washington’s Crypto Push

Inside, I’ll reveal all the critical information you need …

Including why the first family is fully behind it …

As well as why I expect it to rise as Ethereum does …

I’m prepared to rush it …

The Best Way to Play Ethereum’s Rise …

And Crypto’s New Big Three: The Coin to Match Bitcoin and Ethereum …

To your inbox right away.

I just ask one small favor in return.

Give my crypto newsletter, Weiss Crypto Investor, a risk-free try.

Chris: What do members get when they join Weiss Crypto Investor?

Juan: I’m glad you asked, Chris.

Weiss Crypto Investor combines my own personal experience in trading cryptos …

With our proprietary ratings system.

Which predicts the right time to get into the best cryptos …

And when to get out.

Like when I notched wins of 153%, 334% and 478% on Bitcoin.

Or gains of 674% …

826% …

Even 1,136% on Ethereum.

All within a three-to-four-year period.

In fact …

In Weiss Crypto Investor …

We’ve never had a losing trade on either of the two most popular digital currencies.

Go back to when I called the 2018 top …

And the bottom …

To nearly the day.

Weiss Crypto Investor members would’ve had access to that information.

Ahead of the crowd.

You’ll always get my latest updates before anyone in the public hears my predictions.

I won’t say it on TV …

A podcast …

Even in an interview with you, Chris.

Weiss Crypto Investor subscribers always get the breaking news first.

Chris: I think that’s more than fair, Juan.

Especially with the speed at which the crypto market moves.

Juan: Every month, I’ll give you the newest information from my proprietary algorithm.

I’ll show you exactly where we are in the cycle.

And I’ll break down what I think should be bought and sold.

The idea — simple as it is — is to use the timing model.

Letting it show us the best time to enter and exit these cryptos.

Is it always possible to time things exactly?

Of course not, there is no perfect system for investing.

There is risk involved.

People should never be willing to invest more than they can afford to lose.

However our overall track record in Weiss Crypto Investor is remarkable.

We’ve recommended more than 50 crypto trades over the last six years.

The average gain was 288%.

And that includes the losers.

Some of the biggest winners were even more extraordinary.

Like …

1,136% on THORChain in less than four months …

Or returns of 1,629% and 2,925% on Cardano in three years.

Booking these kinds of gains requires precise timing.

That’s why, anytime, there is breaking news …

You’ll be among the first to know …

Whether it’s a change with one of our recommendations …

Or the crypto market as a whole.

But when you join us at Weiss Crypto Investor …

You get an extra level of protection.

The backing of the powerful Weiss Crypto Ratings.

Chris: That’s great, Juan. And what an amazing track record you’ve got.

I agree, you can never have enough support when investing in anything …

Particularly crypto.

Juan: I totally agree.

Separating the wheat from the chaff in crypto can be tricky.

That’s why I teamed up with our analysts at Weiss Ratings.

We worked together to create a completely independent …

Data-driven ratings system for more than 28,000 different cryptos.

Chris: Ah yes, I remember you mentioning this earlier.

This is the same system that’s rated only 0.4% of all cryptos out there a “Buy” or “Hold”?

Juan: That’s the one.

It’s turned out to be a phenomenal tool for predicting which cryptos have promise …

And which should be avoided like a bad habit.

In fact …

This system has issued over 160 different buy ratings since its inception.

The average gain was 417% …

And that includes the losers.

Chris: That’s no small feat, Juan.

Juan: That’s our ultimate goal at Weiss Crypto Investor.

To give our subscribers the best chance of success.

We pride ourselves on being completely independent.

We don’t take handouts from crypto companies trying to gain influence.

We never have …

And we never will.

We don’t rely on emotions when making our recommendations …

We simply let the data guide us.

It hasn’t always been popular.

As a matter of fact …

The first alert our crypto ratings ever issued …

Said that Bitcoin was not a buy.

This was in January of 2018.

Bitcoin had just hit a new all-time high mere weeks before that.

People thought we had lost our marbles.

Believe it or not …

Bitcoin Magazine wrote an op-ed the next day …

Calling our crypto ratings laughably bad.

I probably don’t need to tell you, Chris, who was laughing last.

Chris: Juan, I had a feeling you were going to say that …

Juan: And it didn’t take long either.

Less than two weeks later …

Bitcoin was down 40%.

Listen …

I don’t tell this story to brag.

Simply to point out that at Weiss Crypto Investor …

We don’t worry about the outside noise.

All we do is follow our research to its logical conclusion …

And trust the data to get us where we need to be.

Chris: And that’s a good point, Juan, you mentioned emotions. Emotions are what get a lot of investors in trouble out there, so I’m glad your proprietary timing model takes that out of the equation.

So, between your proprietary timing model …

And the powerful Weiss Crypto Ratings …

It seems like anyone who joins the team …

Has a lot of wisdom and protection behind their investments.

But just to remind everyone …

Here’s everything you get today when you subscribe to Weiss Crypto Investor.

- 12 Monthly Issues. On the fourth Friday of every month, you’ll get a new issue full of Juan’s latest research on the crypto market, along with a fresh recommendation for the next hot crypto.

- ASAP Alerts and Updates. Any time the market swings or something changes with one of Juan’s recommendations, you’ll be the first to know. We’ll send out timely alerts to help you stay ahead of the rest of the crypto market.

- Free subscription to Weiss Crypto Daily. Keep up with the everyday movements of the crypto market with our expert crypto analysis. All of our analysts contribute to bring you the latest news, gossip and investment advice in the world of crypto.

- Full Access to our Weiss Crypto Ratings. Since their inception in 2017, our system has rated 162 cryptos a buy and the average gain was 417% — including the losers. Our proprietary ratings are fed the latest data instantly and are maintained by some of the top data engineers in the world.

- Report #1: The Best Way to Play Ethereum’s Rise. A seismic shift is happening inside the world of crypto. As Wall Street pivots away from Bitcoin, Ethereum is leading the charge. But there’s a lesser-known coin that could soar even higher thanks to their connection with Ethereum.

- Report #2: Crypto’s New Big Three: The Coin to Match Bitcoin and Ethereum. Crypto is about to have a third big player per Juan’s prediction. A new coin that could be mentioned in the same breath as Bitcoin and Ethereum. In this report, Juan reveals the name of the coin and gives you all the details on how you can get in before it potentially becomes a household name.

- Report #3: Trump’s New Favorite Coin: The Best Way to Play Washington’s Crypto Push. The most crypto-friendly administration in history is using its leverage to push crypto into the mainstream world of finance. And one special coin that is closely aligned with the Trump family is seeing a major boost as a result.

Juan: On top of that, Chris, I’ll give you an extra bonus report.

Chris: Another bonus report? That’s music to my ears, Juan.

Juan: I bet it will be to subscribers as well.

Because there is another special benefit to all the cryptos I’ve been talking about today …

Including Ethereum.

Chris: Can’t wait to hear it, Juan.

Juan: The fact is that every single one of these coins …

Are designed in a way that offers an opportunity to make extra money from them …

Simply by owning them.

Chris: Whoa, that’s big news.

Is this like a dividend or an interest payment?

Juan: More towards the latter, Chris.

But …

The rewards are similar to a dividend or interest payment.

It’s called staking.

And it’s really just a type of secure lending.

Chris: Okay, can you give us a little bit more information about that, Juan?

Juan: It’s my privilege.

It’s really very simple.

You are lending your cryptocurrency to the blockchain …

With the purpose of helping the system securely validate other transactions.

Chris: Are these the same type of blockchains that you’ve been talking about Juan?

The ones that Wall Street is so enamored with?

Juan: Those are the ones.

Essentially, these blockchains …

They are like constantly updating spreadsheets.

Instantly updating every time a transaction occurs.

When you lend your crypto to these blockchains …

It helps them work more efficiently.

As a reward …

You earn a percentage back.

Simply for participating in the process.

Just like you would with a savings account at the bank. And because the blockchain is secure …

You can rest assured that your money is safe …

While working for you at the same time.

Chris: That sounds like a fantastic way to earn some extra income from your investments.

Is this something that is common with most cryptos?

Juan: Not at all.

In reality …

It’s a large reason why we are seeing this massive move away from Bitcoin.

Despite its top dog status …

You can’t stake it.

Because it doesn’t use the specific system you need to do it.

But Ethereum does.

It’s a major reason it has so much momentum behind it.

And why so many Wall Street giants are shifting into it.

As well as other coins like it.

Chris: You probably know what question I’m going to ask Juan …

If Ethereum is so good for this, is that not more incentive to load up on it?

Juan: I had a feeling you were going to ask that.

And I think you’re going to like my answer even better.

Because just like I mentioned with Ethereum’s rise …

These other coins I’m excited about offer even higher potential when it comes to staking.

Right now, investors can earn somewhere between 4-6% a year lending out Ethereum.

Chris: Again, a return most investors would be thrilled with.

Especially just as a reward for having it.

Juan: No doubt.

But every one of the cryptos I’ve mentioned today …

Offer a better annual staking return than Ethereum.

In fact …

One of them offers more than triple the return that Ethereum does.

Chris: Well, like always …

You’ve convinced me again, Juan.

But I imagine that staking your crypto is not quite as easy …

As say, putting money into a savings account?

Juan: You’d be right about that, Chris.

There is a method to doing this effectively …

And for the right amount of time.

That’s why I’ve put everything together in a special report called …

Your Guide to Ethereum and Higher Crypto Yields

Inside this report I’ll go through the step-by-step process of how to stake crypto.

Including the benefits for each crypto I’ve recommended.

I’ll also tell you how long I recommend you stake each one for.

To give you the best chance at the highest yearly yield.

Chris: Okay, Juan.

This all sounds great.

Now, how much will it actually cost to subscribe to Weiss Crypto Investor?

Juan: Lower than the price for an entrée at a halfway decent restaurant, Chris.

Less than a tank of gas for your car …

Our normal retail price is $129.

But today …

It’s just $49.

Chris: For a full year?

Juan: That’s right, Chris.

That’s 62% off the retail price.

Chris: Some quick math tells me that’s like 13 cents a day.

Juan: Merely pennies on the dollar, Chris.

It’s the best offer we can make.

Considering you’ll get four free bonus reports — with the names of three promising coins.

Not only that …

You’ll learn how to earn even more from these tokens …

Simply by holding them.

The interest itself could pay for your subscription in no time.

But if for whatever reason …

You are not satisfied during that first year …

Simply contact our member care team …

And they’ll be happy to issue you a full refund.

You can even keep all the reports you received.

Chris: That really is an amazing offer.

Especially considering all that you’ve shown us is happening in crypto right now.

Juan: Thank you, Chris.

What’s happening right now is why we, here at Weiss Crypto Investor …

Want to make such a special offer for you.

Permanent shifts in the crypto world are not common.

I believe this is a huge opportunity to get in on the ground floor …

Of the next big move in the world of crypto.

My proprietary timing model is telling me the time is now.

With Washington pushing crypto into the mainstream …

And Wall Street pouncing on the opportunity …

It’s really a watershed moment for the industry.

There’s a huge opportunity brewing here …

For this very limited handful of coins.

This could be a rare chance to take advantage of all that’s happening.

I really hope you join us for the ride.

Chris: Folks, I think you’ve heard everything you need to hear.

But just as a reminder …

When you subscribe to Weiss Crypto Investor today, here’s all the benefits you’ll receive.

- Benefit # 1: 12 Monthly Issues delivered on the fourth Friday of each month.

- Benefit # 2: ASAP Alerts and Updates on major moves in the market.

- Benefit # 3: Free subscription to Weiss Crypto Daily.

- Benefit # 4: One year of access to our Weiss Crypto Ratings with an average gain of 417% across all 162 closed trades since its inception in 2017.

- Benefit # 5: The Best Way to Play Ethereum’s Rise.

- Benefit # 6: Crypto’s New Big Three: The Coin to Match Bitcoin and Ethereum.

- Benefit #7: Trump’s New Favorite Coin: The Best Way to Play Washington’s Crypto Push.

- Benefit # 8: Your Guide to Ethereum and Higher Crypto Yields.

- Benefit # 9: Our Unconditional One Year Money Back Guarantee.

- Benefit #10: Incredible savings.

For a limited time we are offering all of this for just $49.

That’s 2/3 off our normal retail price.

And remember …

If you are not satisfied with your subscription for whatever reason …

Simply reach out to our member care team and they’ll issue you a full refund …

Even up to the last day of your subscription.

Of course …

Based on all the great information Juan’s shared with us today …

I’d be surprised if you did.

Because there’s a worldwide revolution in finance that’s happening …

It’s undeniable, and it’s being led by a select set of special cryptos.

Opportunities like this are very rare.

And often gone in a hurry.

If you missed out on previous crypto runs …

This is another opportunity to make good on it.

Simply click the button below to subscribe to Weiss Crypto Investor.

And we’ll rush your bonus reports to you immediately …

Including the names of these three promising coins.

Click below to confirm your information …

And get started right away.